Bitcoin is a worldwide cryptocurrency and digital payment system[13]:3 invented by an unknown programmer, or a group of programmers, under the name Satoshi Nakamoto.[14] It was released as open-source software in 2009.[15]

The system is peer-to-peer, and transactions take place between users directly, without an intermediary.[13]:4 These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain. Since the system works without a central repository or single administrator, bitcoin is called the first decentralized digital currency.[13]:1[16]

Besides being created as a reward for mining, bitcoin can be exchanged for other currencies,[17] products, and services in legal or black markets.[18][19]

As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment.[20]According to research produced by Cambridge University in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[21]

The blockchain is a public ledger that records bitcoin transactions.[30] A novel solution accomplishes this without any trusted central authority: maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software.[13] Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.[31] Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain.[32] Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[7]:ch. 5

Transactions[edit]

Transactions are defined using a Forth-like scripting language.[7]:ch. 5 A valid transaction must have one or more inputs.[34] Every input must be an unspent output of a previous transaction. The transaction must carry the digital signature of every input owner. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. A transaction can also have multiple outputs, allowing one to make multiple payments in one go. A transaction output can be specified as an arbitrary multiple of satoshi. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.[34] Any input satoshis not accounted for in the transaction outputs become the transaction fee.[34]

Transaction fees[edit]

Paying a transaction fee is optional.[34] Miners can choose which transactions to process[34] and prioritize those that pay higher fees. Fees are based on the storage size of the transaction generated, which in turn is dependent on the number of inputs used to create the transaction. Furthermore, priority is given to older unspent inputs.[7]:ch. 8

Mining[edit]

Mining is a record-keeping service.[note 5] Miners keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block.[30] Each block contains a cryptographic hash of the previous block,[30] using the SHA-256 hashing algorithm,[7]:ch. 7 which links it to the previous block,[30] thus giving the blockchain its name.

In order to be accepted by the rest of the network, a new block must contain a so-called proof-of-work.[30] The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.[7]:ch. 8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is 0, 1, 2, 3, ...[7]:ch. 8) before meeting the difficulty target.

Every 2016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[7]:ch. 8

Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.[36]

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.[37] As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[30]

Supply[edit]

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.[38] As of 9 July 2016,[39] the reward amounted to 12.5 newly created bitcoins per block added to the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments.[7]:ch. 8 All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins[note 6] will be reached c. 2140; the record keeping will then be rewarded by transaction fees solely.[40]

In other words, bitcoin's inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that there would only ever be 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.[41]

Wallets[edit]

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold[42] or store bitcoins,[43] due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings"[43] and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[44] At its most basic, a wallet is a collection of these keys.

There are several types of wallets. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership.[45] Software wallets can be split further in two categories: full clients and lightweight clients.

- Full clients verify transactions directly on a local copy of the blockchain (over 110 GB as of May 2017[46]), or a subset of the blockchain (around 2 GB[47]). Because of its size and complexity, the entire blockchain is not suitable for all computing devices.

- Lightweight clients on the other hand consult a full client to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet however, the user must trust the server to a certain degree. When using a lightweight client, the server can not steal bitcoins, but it can report faulty values back to the user. With both types of software wallets, the users are responsible for keeping their private keys in a secure place.[48]

Besides software wallets, Internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.[49][50] As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such security breach occurred with Mt. Gox in 2011.[51]

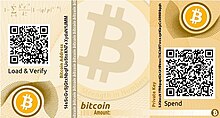

Physical wallets store the credentials necessary to spend bitcoins offline.[43] Examples combine a novelty coin with these credentials printed on metal.[52] Others are simply paper printouts. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.[53]

Reference implementation[edit]

The first wallet program was released in 2009 by Satoshi Nakamoto as open-source code.[15] Sometimes referred to as the "Satoshi client", this is also known as the reference client because it serves to define the bitcoin protocol and acts as a standard for other implementations.[45] In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as Bitcoin-Qt.[45] After the release of version 0.9, the software bundle was renamed Bitcoin Core to distinguish itself from the network.[54][55] Today, other forks of Bitcoin Core exist such as Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited,[56][57] and Parity Bitcoin.[58]

Ownership[edit]

Ownership of bitcoins implies that a user can spend bitcoins associated with a specific address. To do so, a payer must digitally sign the transaction using the corresponding private key. Without knowledge of the private key, the transaction cannot be signed and bitcoins cannot be spent. The network verifies the signature using the public key.[7]:ch. 5

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[13] the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[59]

Decentralization[edit]

Bitcoin creator Satoshi Nakamoto designed bitcoin not to need a central authority.[22] Per sources such as the academic Mercatus Center,[13] U.S. Treasury,[10] Reuters,[16] The Washington Post,[19] The Daily Herald,[60] The New Yorker,[61] and others, bitcoin is decentralized.

Privacy[edit]

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses.[62] Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.[63]

To heighten financial privacy, a new bitcoin address can be generated for each transaction.[64] For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys.[65] Additionally, "mixing" and CoinJoin services aggregate multiple users' coins and output them to fresh addresses to increase privacy.[66] Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.[67]

According to Dan Blystone, "Ultimately, bitcoin resembles cash as much as it does credit cards."[68]

Fungibility[edit]

Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.[69] Projects such as CryptoNote, Zerocoin, and Dark Wallet aim to address these privacy and fungibility issues.[70][71]

Governance[edit]

Bitcoin was initially led by Satoshi Nakamoto. Nakamoto stepped back in 2010 and handed the network alert key to Gavin Andresen.[72]Andresen stated he subsequently sought to decentralize control stating: "As soon as Satoshi stepped back and threw the project onto my shoulders, one of the first things I did was try to decentralize that. So, if I get hit by a bus, it would be clear that the project would go on."[72] This left opportunity for controversy to develop over the future development path of bitcoin. The reference implementation of the bitcoin protocol called Bitcoin Core obtained competing versions that propose to solve various governance and blocksize debates; as of July 2016, the alternatives were called Bitcoin XT, Bitcoin Classic, and Bitcoin Unlimited.[73]

Scalability[edit]

The blocks in the blockchain are limited to one megabyte in size, which has created problems for bitcoin transaction processing, such as increasing transaction fees and delayed processing of transactions that cannot be fit into a block.[74] Contenders to solve the scalability problem are referred to as Bitcoin Cash, Bitcoin Classic,[75] Bitcoin Unlimited,[76] and SegWit2x.[77] On 21 July 2017 miners locked-in a software upgrade referred to as Bitcoin Improvement Proposal (BIP) 91, meaning that the controversial Segregated Witness upgrade will activate at block # 477,120.[78]

History[edit]

Bitcoin was created[15] by Satoshi Nakamoto,[14] who published the invention[15] on 31 October 2008 to a cryptography mailing list[23] in a research paper called "Bitcoin: A Peer-to-Peer Electronic Cash System".[22] Nakamoto implemented bitcoin as open source code and released in January 2009.[15] The identity of Nakamoto remains unknown, though many have claimed to know it.[14]

In January 2009, the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins,[79][80][81][82] with Satoshi Nakamoto mining the first block of bitcoins ever (known as the genesis block), which had a reward of 50 bitcoins.

One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction.[83][84] Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[85]

In the early days, Nakamoto is estimated to have mined 1 million bitcoins.[86] Before disappearing from any involvement in bitcoin, Nakamoto in a sense handed over the reins to developer Gavin Andresen, who then became the bitcoin lead developer at the Bitcoin Foundation, the 'anarchic' bitcoin community's closest thing to an official public face.[87]

The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John's.[79]

On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted. Transactions were not properly verified before they were included in the blockchain, which let users bypass bitcoin's economic restrictions and create an indefinite number of bitcoins.[88][89] On 15 August, the vulnerability was exploited; over 184 billion bitcoins were generated in a transaction, and sent to two addresses on the network. Within hours, the transaction was spotted and erased from the transaction log after the bug was fixed and the network forked to an updated version of the bitcoin protocol.[90][88][89]

Economics[edit]

Classification[edit]

Bitcoin is a digital asset[91] designed by its inventor, Satoshi Nakamoto, to work as a currency.[22][92] It is commonly referred to with terms like digital currency,[13]:1 digital cash,[93] virtual currency,[9] electronic currency,[25] or cryptocurrency.[94]

The question whether bitcoin is a currency or not is still disputed.[94] Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify".[95] Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria.[96] It does best as a medium of exchange; as of February 2015 the number of merchants accepting bitcoin had passed 100,000.[20] As of March 2014, the bitcoin market suffered from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account.[96]

General use[edit]

According to research produced by Cambridge University in 2017, there are between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. The number of users has grown significantly since 2013, when there were 0.3 to 1.3 million users.[21]

Acceptance by merchants[edit]

In 2015, the number of merchants accepting bitcoin exceeded 100,000.[20] Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees in the range from 0% to less than 2%.[97] Firms that accepted payments in bitcoin as of December 2014 included PayPal,[98] Microsoft,[99] Dell,[100] and Newegg.[101]

Payment service providers[edit]

Merchants accepting bitcoin ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service.[102]

Financial institutions[edit]

Bitcoin companies have had difficulty opening traditional bank accounts because lenders have been leery of bitcoin's links to illicit activity.[103] According to Antonio Gallippi, a co-founder of BitPay, "banks are scared to deal with bitcoin companies, even if they really want to".[104] In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin,[105] and HSBC refused to serve a hedge fund with links to bitcoin.[106] Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency;[107] this has become the subject of an investigation by the Australian Competition and Consumer Commission.[107] Nonetheless, Australian banks have keenly adopted the blockchain technology on which bitcoin is based.[108]

In a 2013 report, Bank of America Merrill Lynch stated that "we believe bitcoin can become a major means of payment for e-commerce and may emerge as a serious competitor to traditional money-transfer providers."[109] In June 2014, the first bank that converts deposits in currencies instantly to bitcoin without any fees was opened in Boston.[110]

As an investment[edit]

Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts.[63] During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.[111]

The Winklevoss twins have invested into bitcoins. In 2013 The Washington Post claimed that they owned 1% of all the bitcoins in existence at the time.[112]

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission.[113] Forbes started publishing arguments in favor of investing in December 2015.[114]

In 2013 and 2014, the European Banking Authority[115] and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization,[116] warned that investing in bitcoins carries significant risks. Forbes named bitcoin the best investment of 2013.[117] In 2014, Bloomberg named bitcoin one of its worst investments of the year.[118] In 2015, bitcoin topped Bloomberg's currency tables.[119]

According to Bloomberg, in 2013 there were about 250 bitcoin wallets with more than $1 million worth of bitcoins. The number of bitcoin millionaires is uncertain as people can have more than one wallet.[120]

Venture capital[edit]

Venture capitalists, such as Peter Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc.[121] In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins,[122] at the time called 'mystery buyer'.[123] The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake.[122] Investors also invest in bitcoin mining.[124] According to a 2015 study by Paolo Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).[125]

Price and volatility[edit]

According to Mark T. Williams, as of 2014, bitcoin has volatility seven times greater than gold, eight times greater than the S&P 500, and 18 times greater than the U.S. dollar.[126] According to Forbes, there are uses where volatility does not matter, such as online gambling, tipping, and international remittances.[127]

The price of bitcoins has gone through various cycles of appreciation and depreciation referred to by some as bubbles and busts.[128][129] In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2.[130] In the latter half of 2012 and during the 2012–13 Cypriot financial crisis, the bitcoin price began to rise,[131] reaching a high of US$266 on 10 April 2013, before crashing to around US$50.[132] On 29 November 2013, the cost of one bitcoin rose to a peak of US$1,242.[133] In 2014, the price fell sharply, and as of April remained depressed at little more than half 2013 prices. As of August 2014 it was under US$600.[134] In January 2015, noting that the bitcoin price had dropped to its lowest level since spring 2013 – around US$224 – The New York Times suggested that "[w]ith no signs of a rally in the offing, the industry is bracing for the effects of a prolonged decline in prices. In particular, bitcoin mining companies, which are essential to the currency's underlying technology, are flashing warning signs."[135] Also in January 2015, Business Insider reported that deep web drug dealers were "freaking out" as they lost profits through being unable to convert bitcoin revenue to cash quickly enough as the price declined – and that there was a danger that dealers selling reserves to stay in business might force the bitcoin price down further.[136]

According to The Wall Street Journal, as of April 2016, bitcoin is starting to look slightly more stable than gold.[137] On 3 March 2017, the price of a bitcoin surpassed the market value of an ounce of gold for the first time as its price surged to an all-time high.[138][139] A study in Electronic Commerce Research and Applications, going back through the network's historical data, showed the value of the bitcoin network as measured by the price of bitcoins, to be roughly proportional to the square of the number of daily unique users participating on the network. This is a form of Metcalfe's law and suggests that the network was demonstrating network effects proportional to its level of user adoption.[140]

TAGS

/etc/init.d/bitcoind

/r/bitcoin stats

0 25 bitcoins

0.05 bitcoin in euro

0.1 bitcoins

0.15 bitcoins

0.21 bitcoins

1 bitcoin =

1 bitcoin in 2010

1 bitcoin in inr

1 bitcoin in usd in 2010

1 bitcoin to cad

1 bitcoin to dollar

1 bitcoin to naira

1 bitcoin to us dollars

1 bitcoin to usd

1 bitcoin worth

10th/s bitcoin miner

1th/s bitcoin miner

2 bitcoin price

2 bitcoin qt

2 bitcoin to inr

2 bitcoin to usd

2 bitcoin wallets

2 bitcoins a month

2 bitcoins free

2 bitcoins to dollars

20th/s bitcoin miner

3 bitcoin in euro

3 bitcoin to eur

3 bitcoins

3 bitcoins in gbp

3 bitcoins to usd

4 bitcoin to eur

4 bitcoins in gbp

4 bitcoins to usd

5 bitcoin free

5 bitcoin in euro

5 bitcoin to cad

5 bitcoins to usd

6 bitcoin network confirmations

6 bitcoins in euro

6 bitcoins in usd

7 bitcoin casino

7 bitcoin in euro

7 bitcoin in sterling

7 bitcoin to usd

7 bitcoins in dollars

8 bit bitcointalk

8 bitcoin in euro

8 bitcoins to usd

9 000 bitcoin

9 bitcoins

9 bitcoins to usd

9 euro in bitcoin

9 famous bitcoin addresses

99.9 bitcoin

a bitcoin address

a bitcoin believers crisis of faith

a bitcoin block

a bitcoin client

a bitcoin governance network

a bitcoin miner

a bitcoin primer

a bitcoin to a dollar

a bitcoin to naira

a bitcoin wallet

alpha-t bitcointalk

avalon 6 bitcoin

b&h bitcoin

b-eleven bitcoin

b-wallet bitcoin

bb&t bitcoin

best b#$*h - bitcoin

best b#$*h - bitcoin lyrics

bh f bitcoin

bip 9 bitcoin

bitcoin

bitcoin 0 active connections

bitcoin 0 confirmations

bitcoin 0 fee

bitcoin 0 transaction fee

bitcoin 0.01

bitcoin 0.1

bitcoin 0.12

bitcoin 0.14

bitcoin 0.14.1

bitcoin 0.14.2

bitcoin 0/unconfirmed in memory pool

bitcoin 1 million

bitcoin 10 year chart

bitcoin 100

bitcoin 100 000

bitcoin 100 dollars

bitcoin 10000

bitcoin 100k

bitcoin 101

bitcoin 10k

bitcoin 148

bitcoin 2 paypal

bitcoin 2 year chart

bitcoin 2.0

bitcoin 2009

bitcoin 2010

bitcoin 2011

bitcoin 2012

bitcoin 2013

bitcoin 2017

bitcoin 2018

bitcoin 2020

bitcoin 2025

bitcoin 3 address

bitcoin 3 confirmations

bitcoin 3 day chart

bitcoin 3 month chart

bitcoin 3 unlimited

bitcoin 3 year chart

bitcoin 300

bitcoin 3000

bitcoin 30000

bitcoin 35 million

bitcoin 365 club

bitcoin 3k

bitcoin 3x etf

bitcoin 4 cash

bitcoin 4 euro

bitcoin 4 igaming

bitcoin 4 million

bitcoin 4 november

bitcoin 4 u

bitcoin 4 year chart

bitcoin 4 years ago

bitcoin 4.4 million

bitcoin 4000

bitcoin 40000

bitcoin 401k

bitcoin 401k rollover

bitcoin 4chan

bitcoin 4k

bitcoin 5 day chart

bitcoin 5 min

bitcoin 5 minutes

bitcoin 5 unlimited generator

bitcoin 5 year chart

bitcoin 5 year prediction

bitcoin 5 years

bitcoin 5 years ago

bitcoin 500

bitcoin 500 000

bitcoin 5000

bitcoin 50000

bitcoin 51 attack

bitcoin 5dimes

bitcoin 6 cents

bitcoin 6 confirmations

bitcoin 6 confirmations time

bitcoin 6 month

bitcoin 6 month chart

bitcoin 6 month price

bitcoin 6 year chart

bitcoin 6 years ago

bitcoin 6 years behind

bitcoin 60 day chart

bitcoin 60 minutes

bitcoin 6000

bitcoin 666

bitcoin 7 day chart

bitcoin 7 eleven

bitcoin 7 transactions per second

bitcoin 7 years

bitcoin 7 years ago

bitcoin 7-11

bitcoin 70 million

bitcoin 711

bitcoin 72 million

bitcoin 72.9 million

bitcoin 73 million

bitcoin 75 million

bitcoin 8 active connections

bitcoin 8 connections

bitcoin 8 decimal places

bitcoin 8 million

bitcoin 8 years ago

bitcoin 8 years behind

bitcoin 8/1

bitcoin 80

bitcoin 800

bitcoin 800 number

bitcoin 8333

bitcoin 8949

bitcoin 8mb

bitcoin 8nv

bitcoin 9 banks

bitcoin 9 confirmations

bitcoin 9 million garbage

bitcoin 90 day chart

bitcoin 9000

bitcoin 94fbr

bitcoin 980 gtx

bitcoin 980 ti

bitcoin 99

bitcoin 99 faucet

bitcoin 9arm

bitcoin 9gag

bitcoin abc

bitcoin ac id

bitcoin account

bitcoin address

bitcoin all time high

bitcoin and blockchain

bitcoin app

bitcoin asic

bitcoin atm

bitcoin atm arizona

bitcoin atm near me

bitcoin atm phoenix

bitcoin b font

bitcoin b symbol

bitcoin bank

bitcoin baron

bitcoin billionaire

bitcoin block explorer

bitcoin blockchain

bitcoin blockchain size

bitcoin bot

bitcoin brain

bitcoin bubble

bitcoin buy

bitcoin by paypal

bitcoin c sharp

bitcoin c==

bitcoin calculator

bitcoin cash

bitcoin cash news

bitcoin cash wallet

bitcoin casino

bitcoin chart

bitcoin core

bitcoin crash

bitcoin creator

bitcoin currency

bitcoin current value

bitcoin dark

bitcoin day trading

bitcoin debit card

bitcoin debit card usa

bitcoin definition

bitcoin dice

bitcoin documentary

bitcoin dollar

bitcoin download

bitcoin drop

bitcoin e card

bitcoin e commerce

bitcoin e money

bitcoin e pill

bitcoin e wallet

bitcoin e-currency

bitcoin e-voucher

bitcoin e.g. crossword

bitcoin e.g. crossword clue

bitcoin ebay

bitcoin ebook

bitcoin etf

bitcoin ethereum

bitcoin ethereum price

bitcoin exchange

bitcoin exchange rate usd

bitcoin exchange usd

bitcoin exchanges in the us

bitcoin explained

bitcoin explorer

bitcoin farming

bitcoin faucet

bitcoin fees

bitcoin for sale

bitcoin forecast

bitcoin fork

bitcoin forum

bitcoin founder

bitcoin fund

bitcoin future

bitcoin games

bitcoin gemini

bitcoin generator

bitcoin gift card

bitcoin github

bitcoin gold

bitcoin graph

bitcoin graph usd

bitcoin growth

bitcoin guide

bitcoin guiminer

bitcoin h/s

bitcoin hack

bitcoin hack v.2

bitcoin halving

bitcoin hard fork

bitcoin hardware

bitcoin hardware wallet

bitcoin hashrate

bitcoin historical chart

bitcoin historical price

bitcoin history

bitcoin how to buy

bitcoin images

bitcoin in usd

bitcoin index

bitcoin india

bitcoin inventor

bitcoin investment

bitcoin investment trust

bitcoin investment trust stock

bitcoin ipo

bitcoin ira

bitcoin irs

bitcoin j

bitcoin j vty

bitcoin japan

bitcoin japan exchange

bitcoin japan legal

bitcoin japan news

bitcoin jesus

bitcoin jobs

bitcoin joe rogan

bitcoin jokes

bitcoin july 2017

bitcoin june 2017

bitcoin k

bitcoin k chart

bitcoin k line

bitcoin k value

bitcoin k-market

bitcoin key

bitcoin keychain

bitcoin khan academy

bitcoin kiosk

bitcoin kiosk near me

bitcoin knots

bitcoin knowledge

bitcoin korea

bitcoin kraken

bitcoin kurs

bitcoin l'altra faccia della moneta

bitcoin l-39

bitcoin latest news

bitcoin ledger

bitcoin legal

bitcoin lending

bitcoin live price

bitcoin loan

bitcoin locations

bitcoin login

bitcoin logo

bitcoin lottery

bitcoin m of n transactions

bitcoin m-pesa

bitcoin machine

bitcoin machine near me

bitcoin magazine

bitcoin market cap

bitcoin millionaire

bitcoin miner t720

bitcoin miner-c pup

bitcoin miner.b

bitcoin miner.g

bitcoin miner.u

bitcoin miner.w

bitcoin miners

bitcoin mining

bitcoin mining hardware

bitcoin mining pool

bitcoin mining rig

bitcoin mining software

bitcoin n.ireland

bitcoin nasdaq

bitcoin net worth

bitcoin network

bitcoin network fee

bitcoin news

bitcoin news india

bitcoin news reddit

bitcoin node

bitcoin now

bitcoin nyse

bitcoin o'reilly

bitcoin o'reilly pdf

bitcoin of america

bitcoin official site

bitcoin offline wallet

bitcoin online

bitcoin online wallet

bitcoin options

bitcoin or ethereum

bitcoin outlook

bitcoin owner

bitcoin paper wallet

bitcoin phoenix

bitcoin pizza

bitcoin predictions

bitcoin price

bitcoin price chart

bitcoin price history

bitcoin price prediction

bitcoin profit calculator

bitcoin projections

bitcoin purchase

bitcoin q

bitcoin q es

bitcoin q significa

bitcoin qr code

bitcoin qr code scanner

bitcoin qt

bitcoin qt update

bitcoin quantum

bitcoin quantum computers

bitcoin que es

bitcoin questions

bitcoin quora

bitcoin quote

bitcoin rate

bitcoin real time

bitcoin reddit

bitcoin regulation

bitcoin review

bitcoin rich list

bitcoin rig

bitcoin rise

bitcoin risk

bitcoin rival

bitcoin s curve

bitcoin segwit

bitcoin services inc

bitcoin split

bitcoin stock

bitcoin stock chart

bitcoin stock market

bitcoin stock price

bitcoin stock ticker

bitcoin store

bitcoin symbol

bitcoin t shirt

bitcoin t shirt india

bitcoin t shirt store

bitcoin t shirt uk

bitcoin taxes

bitcoin ticker

bitcoin to aud

bitcoin to btc

bitcoin to euro

bitcoin to gbp

bitcoin to inr

bitcoin to paypal

bitcoin to usd

bitcoin trading

bitcoin transaction

bitcoin transaction fee

bitcoin trend

bitcoin u bosni

bitcoin u crnoj gori

bitcoin u dinarima

bitcoin u kune

bitcoin uasf

bitcoin uncensored

bitcoin unconfirmed transaction

bitcoin unicode

bitcoin unlimited

bitcoin unlimited price

bitcoin update

bitcoin usa

bitcoin usd

bitcoin uses

bitcoin v blockchain

bitcoin v dollar

bitcoin v euro

bitcoin v gold

bitcoin v litecoin

bitcoin v onecoin

bitcoin value

bitcoin value 2020

bitcoin value in 2009

bitcoin visa

bitcoin volatility

bitcoin vs bitcoin cash

bitcoin vs ethereum

bitcoin vs gold

bitcoin vs litecoin

bitcoin vs usd

bitcoin w chinach

bitcoin w chmurze

bitcoin w górę

bitcoin w niemczech

bitcoin w polsce

bitcoin w polsce legalny

bitcoin w prawie polskim

bitcoin w żabce

bitcoin wallet

bitcoin wallet address

bitcoin wallet app

bitcoin wallet online

bitcoin website

bitcoin what is it

bitcoin whitepaper

bitcoin wiki

bitcoin winklevoss

bitcoin xapo

bitcoin xbox

bitcoin xbt

bitcoin xe

bitcoin xmr

bitcoin xpub

bitcoin xrp

bitcoin xt

bitcoin xt d

bitcoin xt price

bitcoin y control de cambio

bitcoin y deep web

bitcoin y el lavado de dinero

bitcoin y lavado de dinero

bitcoin y litecoin

bitcoin yahoo finance

bitcoin year

bitcoin year started

bitcoin yearly chart

bitcoin yellow paper

bitcoin yen

bitcoin yes or no

bitcoin youtube

bitcoin ytd

bitcoin ytd return

bitcoin z value

bitcoin zapwallettxes

bitcoin zcash

bitcoin zebpay

bitcoin zebra

bitcoin zero

bitcoin zero confirmations

bitcoin zero knowledge proof

bitcoin zerohedge

bitcoin zhihu

bitcoin zimbabwe

bitcoin.d

bitcoin.n

bitcoind backup

bitcoinj micropayments

bitcoinj tutorial

bitcoins 4 backpage

bitcoins 6 months

bitcoins que significa

bitcoins value

bitcoinspot.n

bitcointalk

bitcointalk c-cex

bitcoinwisdom

bitcoiny w polsce

brother john f bitcoin

buy bitcoin

c bitcoin library

c bitcoin miner

c bitcoin wallet

c&h bitcoin

c't bitcoin

capital b bitcoin

co z bitcoinem

coins.h bitcoin

d las vegas bitcoin

d'angelo bitcoin

d-wave bitcoin mining

debian 8 bitcoin

ecuador y bitcoin

f# bitcoin

g bitcoin charts

g bitcoin mining calculator

g bitcoin price

g bitcoin value

g cash to bitcoin

g coin bitcointalk

gh/s bitcoin

ghash bitcoin

h&r block bitcoin

h-not-zero bitcoin

hash.h bitcoin

i bitcoin = satoshi

i bitcoin in indian rupees

i bitcoin in rs

i bitcoin is equal to

i bitcoin to dollar

i bitcoin to inr

i bitcoin to naira

i bitcoin to pkr

i bitcoin to usd

i bitcoin trading

init.d bitcoind

j maurice bitcoin

j p morgan bitcoin

john k bitcoin

k čemu bitcoin

k-market jätkäsaari bitcoin

l'ambassade bitcoin

l'avenir des bitcoins

l'avenir du bitcoin

l'histoire du bitcoin

l'inventeur du bitcoin

l'origine du bitcoin

l'évolution du bitcoin

l-39 bitcoin jet

m get bitcoin

m lhuillier bitcoin

m of n bitcoin

m pesa vs bitcoin

m.bitcoin2048

m.bitcoin2048.com отзывы

main.h bitcoin

mary j bitcoin

mary j bitcoin belle

mary j bitcointalk

mel b bitcoin

mercado bitcoin

mh/s bitcoin

msil bitcoin miner-f

n&p bitcoin consulting

nakup zlata z bitcoini

nvidia titan z bitcoin

nvidia titan z bitcoin mining

o bitcoin e seguro

o bitcoinu

o'reilly bitcoin and the blockchain

p np bitcoin

p-free bitcoin

piotr_n bitcoin

piotr_n bitcointalk

plan b bitcoin

price of bitcoin

q comprar con bitcoins

q es el bitcoin

q es un bitcoin

q son bitcoins

q son los bitcoins

r bitcoin canada

r bitcoin mining

r bitcoin package

r bitcoin videos

r bitcoinmarkets

r bitcoinwisdom

r.i.p. bitcoin

r/bitcoin beg

r/bitcoinmining

r/bitcoinxt

shares in bitcoin

siriusxm bitcoin

sklep z bitcoinami

sve o bitcoin

system d bitcoin

t-110 bitcoin mining system

th/s bitcoin

th/s bitcoin miner

the d bitcoin atm

titan z bitcoin

titan z bitcoin mining

trgovanje z bitcoini

triple m bitcoin

u.s. bitcoin exchange

utorrent bitcoin

why u bitcoin billionaire

wii u bitcoin

win32/bitcoinminer.p

windows 7 bitcoin miner

windows 8 bitcoin miner

x bitcoin generator

y combinator bitcoin

ybitcoin magazine

z cash bitcoin

обменник bitcoin

No comments:

Post a Comment